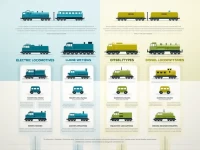

Global HS Codes for Railway and Tramway Components Explained

This article provides an in-depth analysis of the HS codes related to 86, covering the classification, measurement methods, and export tax rebate policies for railway and tramway accessories. It aims to assist businesses in understanding compliance details in international trade, optimizing transportation costs, and improving market entry strategies.